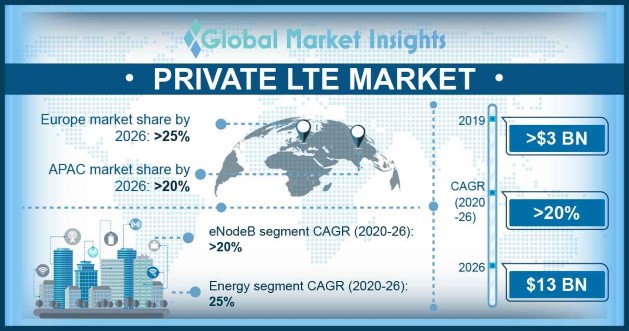

Global Market Insights’ recent report on the Private LTE Market revealed an encouraging trend towards increased uptake of these networks. Based on 2019 analysis, and including market data from 2015 to 2018, projections show an annual CAGR of 20%, taking the $3 billion USD market size to around $13 billion by 2026. Even allowing for the slowdown inevitably caused by the Covid-19 pandemic, the industry is predicted to show impressive, steady growth in years to come.

There are several reasons for GMI’s confidence in these predictions. Although delays in the rollout of public 5G networks has slowed developments in some regions, other countries have seen an expansion in demand caused by a move towards increased remote working. In order to protect business continuity, profitability and data security, some businesses and organisations have invested in Private LTE network infrastructure.

Different Opportunities in Different Territories

Within the US, capital and operating expenditure challenges have been addressed by developing private LTE networks. One major benefit is the greater degree of control such networks allow for bandwidth usage expansion during busy times, and reduction during slow periods, to optimize efficiency, and reduce operating costs. For example, AT&T launched FirstNet EPC to give public safety agencies the ability to increase network resource allocation as and when required, ensuring continuity of service during emergencies.

Meanwhile IoT modules are predicted to become more and more popular, especially in the Chinese market, with predicted growth of 26% for this sector. This huge expansion is driven in part by the need for efficient long-range communication for utilities, smart streets, and environmentally efficient buildings, as well as consumer devices such as wearable health and fitness technology.

Saudi Arabia has been working to improve its public transport networks, and this entails high-traffic data transfer capabilities for railways, buses, the metro and innovative driverless trains. Private LTE allows for improved surveillance, remote monitoring and maintenance, passenger information and the ability to provide complementary internet connectivity to passengers. A CAGR of 30% is expected within the region for Private LTEs.

In Europe, 5G-ready networks and private LTEs are being developed for both businesses and public sector agencies. Emergency services in countries such as Norway, Finland and Poland have been reliant on TETRA networks, but now see the potential in wireless communication networks including broadband and private LTE.

Collaboration is the Future of Private LTE

Rather than rival technology providers offering a host of competing private LTE systems, there has been a trend towards collaboration between strategic ecosystem partners. Many of the key players test their technology on their own campuses before rolling it out to potential clients.

Key players in the field include AT&T, Cisco, Ericsson, Future Technologies, General Dynamics, Huawei, Motorola, Nokia, PDV Wireless, Qualcomm, Rivada Networks, Samsung, SpiderCloud Wireless, Verizon, and ZTE.

However, new entrants are emerging every quarter, taking advantage of the trend towards greater private LTE adoption. Meanwhile, new use cases are emerging too, including autonomous vehicles, smart freeways, drone delivery services and more.

Should GMI’s market predictions prove accurate, there has never been a better time to invest in private LTE start-ups, and the future looks rosy indeed.